The immediate asset write off benefits that have been further enhanced by the federal government this year present small business retailers investing capital in their businesses tax and other benefits that are worth considering.

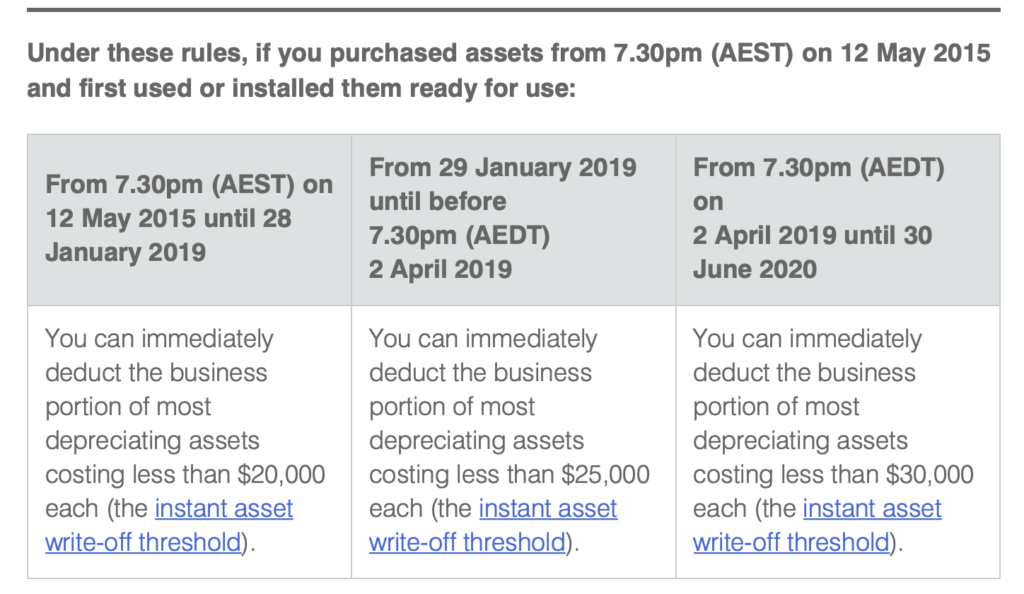

The details of what we in small businesses can do are outlined in the simpler depreciation for small businesses information from the Australian Taxation Office:

Right now, the threshold is $30,000. Spend this much on a depreciating asset and you can write it off this financial year. If your business books a profit, the benefit of the write-off can be considerable.

The Tax Office website has excellent details. Your accountant can help too.

The Small Business Development Corporation in Western Australia has an excellent explainer of instant asset write off on their website. Click here to access it.

Click here to access an explainer from Finstro, a business finance company.