Requests from schools, charities and other community for donations can be a challenge for any size business. If you do not take a structured approach to this you will find yourself giving away plenty for little or no return.

Requests are often loaded with guilt. People can be passive aggressive in their approach. Often, people requesting help leverage pester power. It can be hard to say no. There are too many stories of retailers giving a gift as a prize, receiving the Thank You poster and achieving no benefit for the business.

having heard many stories from our POS software customers and experience ourselves in running retail businesses, we have put together advice for small business retailers on this challenge of the constant stream of community groups asking for donations.

Our advice is to manage your philanthropy as you would any business activity.

THE PRIZE / GIFT

Decide the amount in cash or product value or both that you are prepared to donate in a full year, calendar year or financial year.

Our recommendation is you give away cash, but in the form of a voucher to spend in your business. This ensures that value of the gift or prize is greater than the cost of it to your business.

The best mechanism for giving away cash or an amount to spend in-store is to do it by way of a gift voucher. Use your software to manage this as any manual approach is dangerous and time-consuming.

YOUR PITCH, NOT THEIRS

Get on the front foot and write to local community groups outlining that you budget a year in advance. Seek their submissions. With this advice sheet we have included the text of a suggested letter. Please read the letter as it outlines the approach we suggest and why. It is important you communicate this with all community groups.

On the page after the letter is a suggested notice for use in-store when you are asked for donations.

HOW TO PICK GROUPS TO SUPPORT

Focus on community groups that support you. That is, groups with members who support you. The more they support you the better you are able to support the community.

Be prepared to ask where people shop for the items you sell in your business. Ask if they will change in return for your support.

Asking these questions underscores to you the importance of approaching the decision as a business decision.

Be thoughtful and deliberate. Support the groups that support you. This is important as it helps you stay within a budget.

LET YOUR SHOPPERS CHOOSE

If you run discount vouchers and if customers say they don’t want the voucher, invite them to contribute the voucher to a local group – one of three you setup for in the business. Every month, two months or three months, tote up the vouchers and give the group a parentage of the total voucher value ‘voted’ for them.

This idea could be in addition to any giving program you run in the business. It offers a daily reminder of your commitment to local giving.

Grill’d burgers run a program kind of like this where each shopper is given a bottle cap, which they place in a tub to vote on a group to receive a cash donation for the month. The process of groups submitting to be considered is onerous. You can find out more about that program with this link – it is a good place to research what others do: https://www.grilld.com.au/localmatters/

REWARD ENGAGEMENT

In addition to any direct gift, consider an offer whereby anyone who is a member of the group who shops with you accrues an amount you donate to the group. You could manage this through your software. It could be you offer a discount to the shopper as well as accruing a value for the group.

This type of program could also be in addition to your core giving program as the value here is driven by sales – hopefully, incremental sales.

EDUCATE GROUPS ABOUT GOOD ENGAGEMENT

Here are things groups you support can do to help your business. You should ask them to do these things:

- Tell members to buy from you.

- Write about your business on their Facebook page.

- Distribute flyers of your offers.

- Have you speak at a meeting.

WRITE ABOUT YOUR ENGAGEMENT

Once you have a decision on which groups you will support, write about this in your newsletter and on Facebook. Not just once but multiple times. Invite them to provide you with content to publish too. Talk about their good works.

Ask them to write about you too.

Your giving must serve your heart and serve your business. Going about it in a structured way will ensure you meet your objectives.

Here is suggested text for a letter:

[date]

Good morning

I write to invite your community group to submit a proposal to be considered one of the groups we support this coming year. We are taking this more formal approach rather than considering donation requests when they are pitched trough the year.

We are a small family business with limited resources. We seek to be engaged with community groups that support us as the more successful we are the more we can help the community.

The approach we are taking here is to allow us to plan our giving, to be deliberate in the support we provide.

We will not take on donations through the year from groups who call or visit. While this may seem unfair, we think it will result in more valuable support for the groups we engage with.

In addition to a financial donation, we will support the groups we select through promotion on our business Facebook page and in other practical ways. We want an involvement that is more than just financial, we want to help the groups we partner with to reach further into the community.

To help us consider your business please provide a one page written submission that briefly outlines:

- The goal of the group.

- Number of members.

- What you stand for.

- The work you do.

- Why it matters to the community.

- How a relationship with you could help the community.

We will consider all submissions at the same time and advise the outcome of our deliberations.

We look forward to hearing from you.

Here is suggested text for a notice:

OUR POLICY ON HANDLING COMMUNITY GROUP DONATIONS.

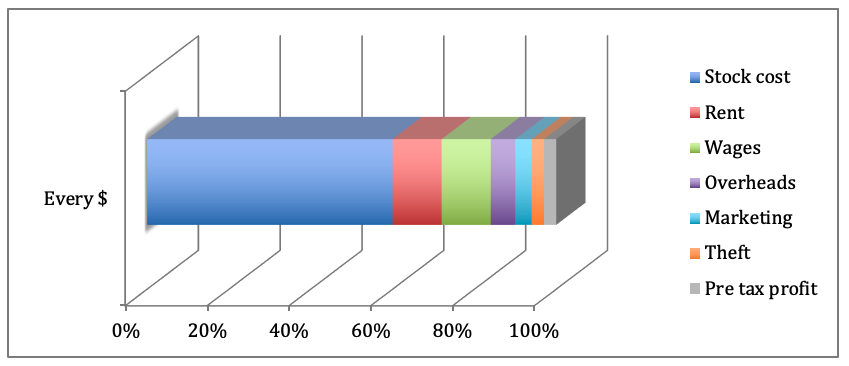

We receive requests to support local community groups and charities regularly. As a small family business with loans, rent, wages and other costs, we cannot say yes to everyone. We wish we could but we cannot.

To help us better connect with and serve the groups we do support, we now decide at the start of the financial year the groups we will support over the next year. The selection process is based on written submissions from groups.

Our decision to select the groups we support at the start of the year means we cannot take on additional donation requests through the year.

We hope you understand and respect this.

Please consider applying in advance of the start of the next financial year.

But all is not lost…

If your group can bring in new customers to our business to purchase items they want we may have another way we can help. Ask us for details.

Thank you and we wish you all the best in your community group.

Recent Comments