We, Australians, small business retailers, suppliers to small business retailers, local towns, all of us need a Royal commission into retail shopping centre development in Australia and the behaviour of shopping centre landlords.

There is enough evidence to indicate that an appropriately skilled and resourced Royal Commission could uncover behaviour that is illegal and harmful to our economy and small businesses and families that rely on the small businesses.

I appreciate that the areas I think the suggested Royal Commission cover are broad and could be better served as two investigations. However, the two issues feed into each other. I think they are best considered together.

WHAT IS A SHOPPING CENTRE?

For the purposes of my proposal, I suggest that a shopping centre is a retail development with fifteen or more shops of any size.

While I am sure there is misbehaviour to consider in smaller centres, for management and focus, a threshold of fifteen tenancies, or similar, is needed. Otherwise, any Royal Commission would run too long and cost too much.

RETAIL SHOPPING CENTRE DEVELOPMENT.

This is the beginning of the issue. Whereas in the US and other countries growth in retail tenancy space is flat or declining, in Australia it continues to grow. Some say we already have far more shops that the population can support.

In regional and rural locations the challenge is that a new centre is usually located outside town and its development can gut the centre of town, diluting or killing off the heart of a small town.

In some cases, mid-size centre development tis driven by competition by the two major supermarkets and aided and abetted by several other anchor tenants and supported by Tatts keen to be in all new centres.

- Do we need more shopping centre space?

- Should there be controls on approving this?

- What is the economic impact of the current growth in retail space in Australia?

- What is the social impact of the current growth in retail space in Australia?

- What is the impact, specifically on small business retailers of the growth in retail space?

LANDLORD BEHAVIOUR.

Talk to any small business tenant in a shopping centre and they will have at least one landlord story that causes them stress.

There is the landlord who did a handshake deal with a party that was negotiating to buy a business. the landlord squeezed and the family business closed. The new tenant moved in without paying goodwill.

There is the landlord that took too long on centre re-develoopmnent, making decisions that saw a 50% drop in shopper traffic, and refused any compensation for retailers.

There is the landlord that permits one sore to be on a % deal where they pay 9% of turnovers in rent with a shop next door not able to have such a deal and managing and occupancy cost of 32%.

There is the landlord that strong-arms retailers verbally, never in writing, never in a way that can be used against them.

There is the landlord that takes a marketing levy every month and spends this on activities that offer no benefit whatsoever to retailers.

There are hundreds of stories.

The Royal Commission needs to listen to stories, all stories. Tenants need to be able to do this confidentially as the fear of reprisal by landlords is real.

- Do landlords act unlawfully?

- Do landlords treat retailers differently?

- Do landlords act in secret knowingly harming small business retailers?

- Do landlords abuse funds they collect from retailers for marketing?

- Are landlords fulfilling their obligations in terms of bringing traffic to shops in their centres?

- How are the various roles of employees paid in landlord businesses? What are their incentives?

There are many other questions to answer. My goal here is to kick off the discussion.

WHY?

Too many families are losing their businesses, homes and other assets. Too many small business operators are having their personal situations, including health, negatively impacted. Too many small business operators are losing their life. Yes, this issue is that serious.

Small business retailers feel helpless. They want their business. It has been their life’s work. They fear without it they will have nothing. This can see them agree to a lease that is at its very foundation doomed inappropriate for their business.

Landlords have the upper hand. They are in control. Too many people in landlord businesses are bullies and aware of how to bully without being caught.

The best way to resolve this is to shine a light. Only a Royal Commission c an have the authority and power to do this.

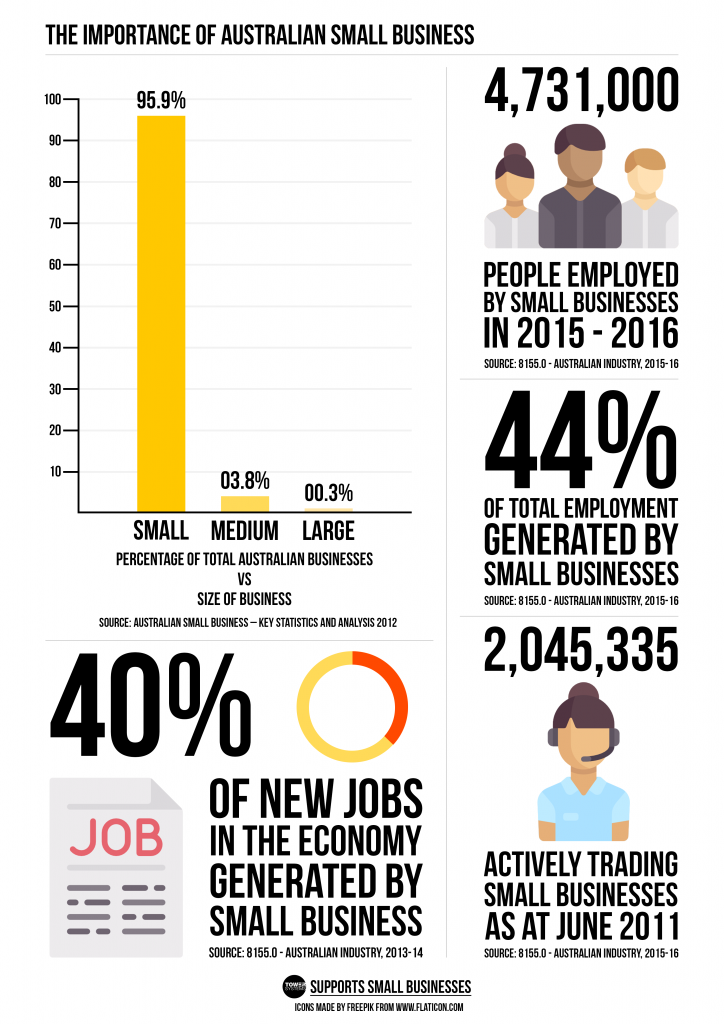

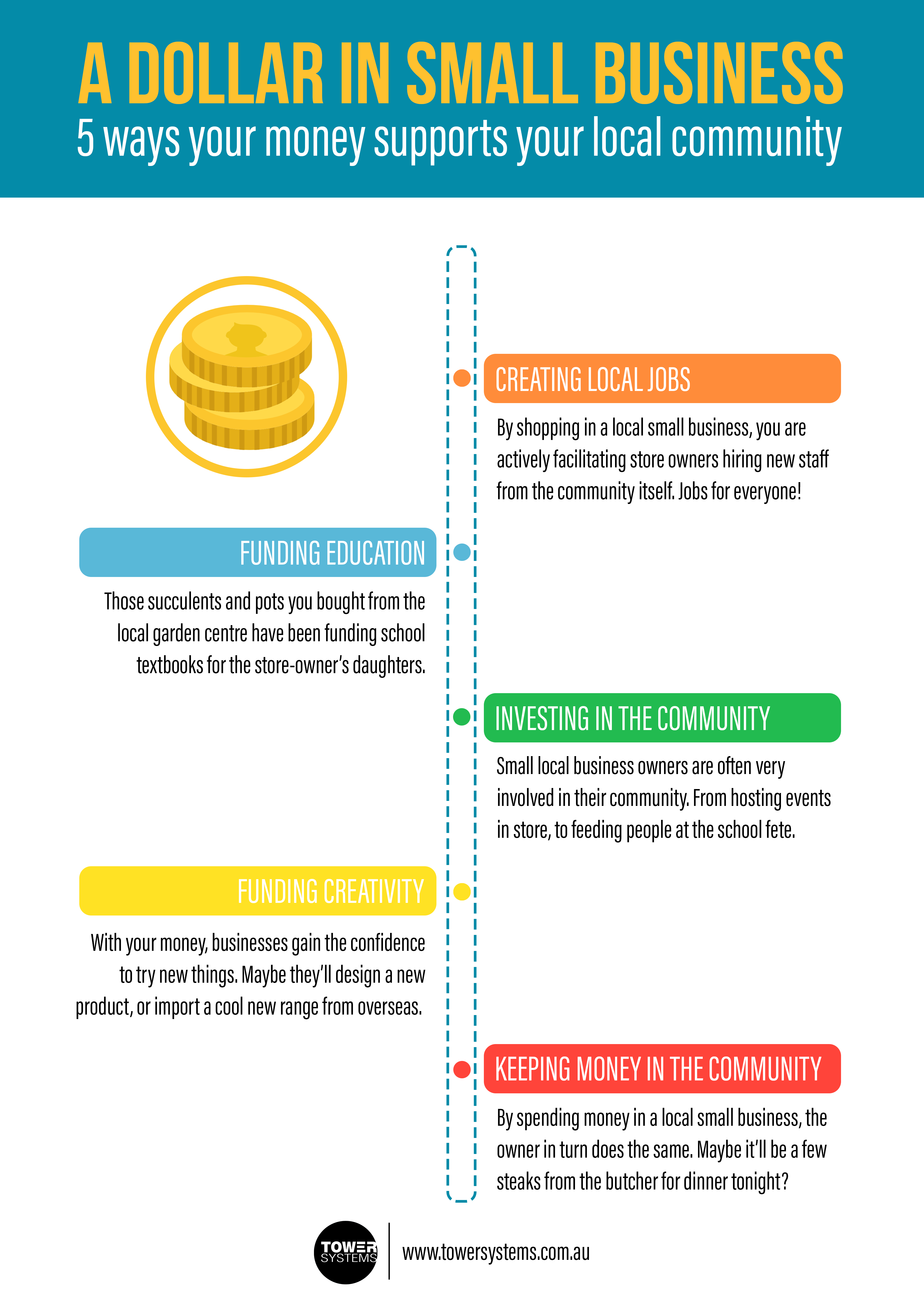

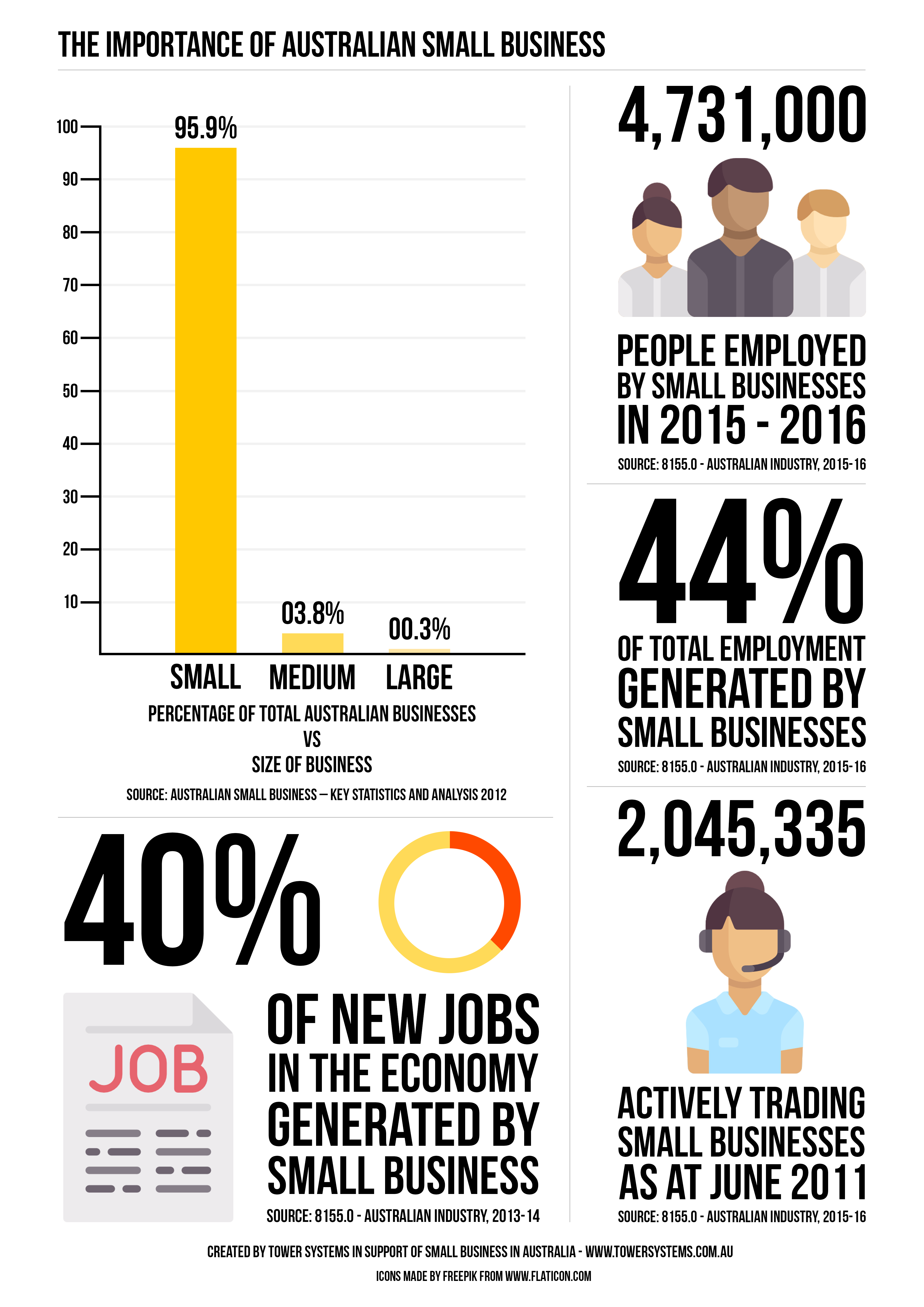

I get that Royal Commissions are popular right now. This suggestion, however, is important given that those most impacted are also those most vulnerable – small businesses, run by families. Were are told small business is the business backbone of our country. However, there is evidence to suggest that small business retailers are disadvantaged in terms of shopping centre development and retail teensy negotiation.

Here at Tower Systems we only serve small business retailers with our POS software. In our view, small business matters. This is why we support the push for a Royal Commission into shopping centre development and retail tenancies.

This post first appeared on a blog last week in a post by the CEO of Tower.

Recent Comments